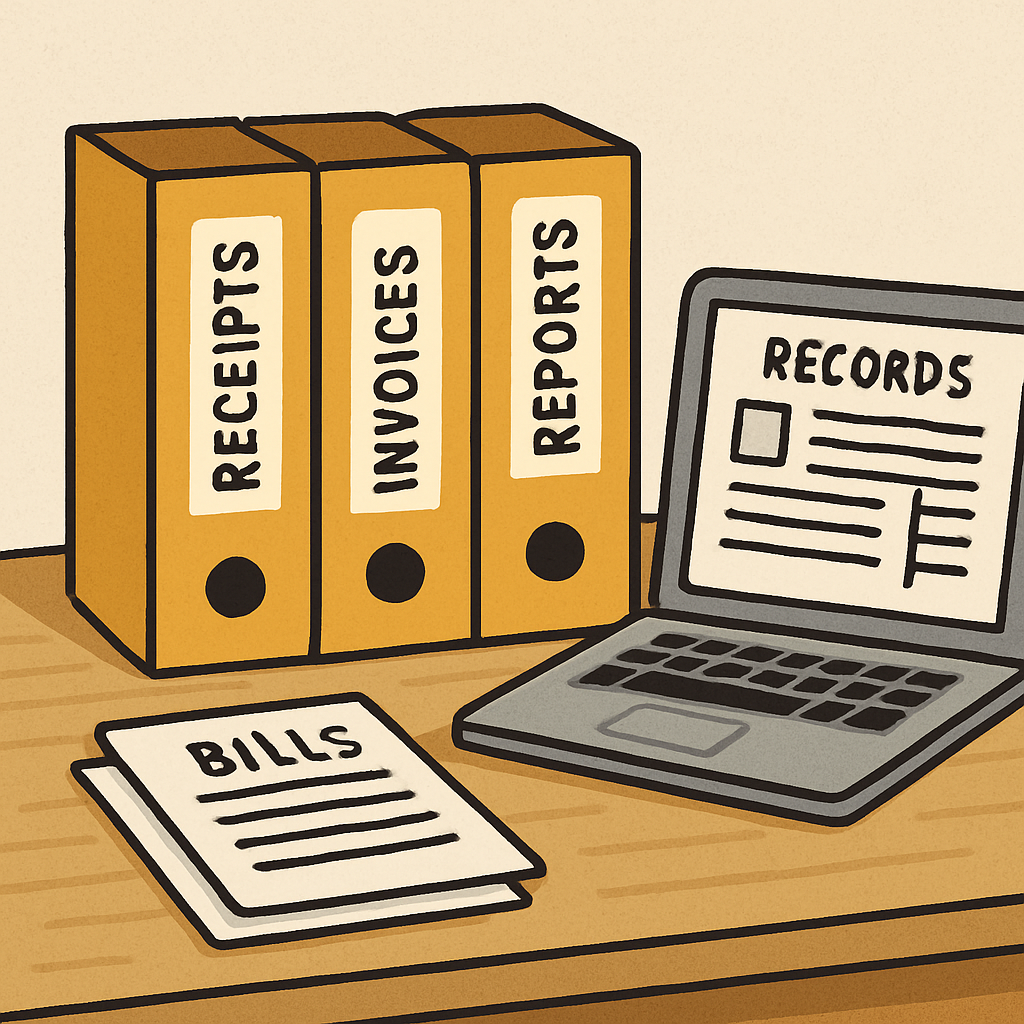

The bookkeeping process involves recording transactions in an organized manner so that you can easily track income and expenses. It also helps you prepare financial reports for tax purposes.

They keep track of your income and expenses

If you own a business, you need to hire a bookkeeper who will help you manage your finances. This includes tracking sales and purchases, preparing invoices, paying bills, and filing taxes.

They help with payroll

Payroll is an essential part of running any business. It helps keep track of employee wages, benefits, and taxes. Without a good bookkeeping system, you won’t be able to accurately calculate how much money you owe to employees, vendors, and government agencies.

They make sure your taxes are filed correctly

If you’re self-employed, you need to file quarterly tax returns with the ATO. This includes filing your personal income tax return, as well as your payroll tax return. In addition, you must also pay estimated quarterly taxes based on your previous year’s earnings.

They help with invoicing

As an independent contractor, you will likely receive invoices from clients at different times throughout the year. It’s important to keep track of these invoices so you can accurately calculate how much money you owe to the government.

They help with bookkeeping

If you hire a bookkeeper, they will take care of the accounting side of things. This means they will make sure you are properly tracking your income and expenses. They will also prepare reports showing you where your money went and how much you spent.