Essential Bookkeeping Checklist for Small Businesses

Bookkeeping is the backbone of small business finance. It ensures that your financial records are accurate and up-to-date.

A well-organized bookkeeping checklist can simplify this process. It helps you track income, expenses, and prepare for tax season.

Small business owners often juggle many tasks. Bookkeeping might seem daunting, but it doesn’t have to be.

With the right tools and strategies, you can streamline your financial management. This guide will provide you with an essential bookkeeping checklist.

Stay organized, save time, and empower your business with effective bookkeeping practices. Let’s dive into the details.

Why Bookkeeping Matters for Small Business Finance

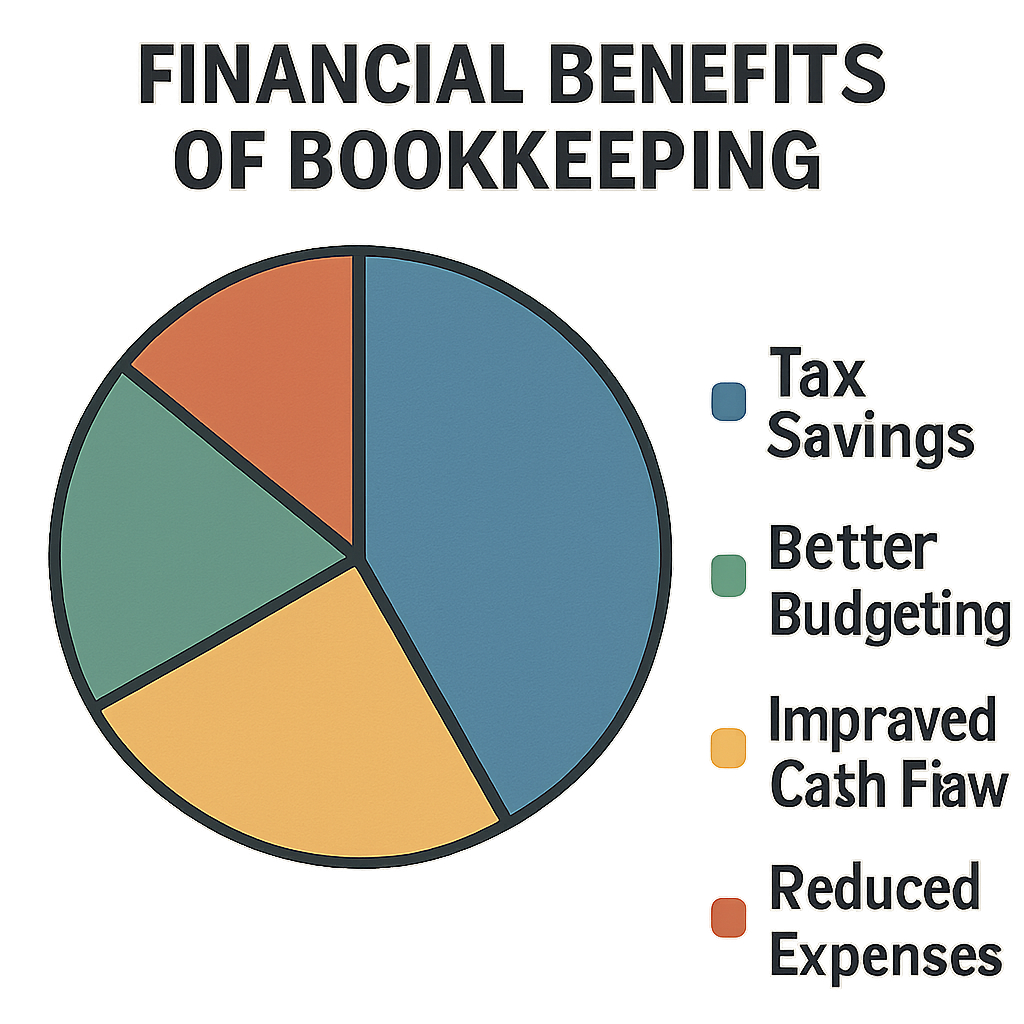

Bookkeeping is crucial for small business finance. It provides a clear view of your financial health. Accurately tracking income and expenses ensures informed decisions.

For any small business, consistent bookkeeping helps in identifying financial patterns. You can spot trends, forecast cash flow, and avoid costly mistakes. A tidy financial picture aids in planning for future growth.

Not only does bookkeeping streamline tax preparation, but it also ensures compliance with financial regulations. Avoid penalties by maintaining detailed records. This practice can save money and reduce stress during tax season.

Moreover, lenders and investors often require financial statements. Good bookkeeping attracts potential investment and funding. Keep your books in order to boost your business’s credibility.

Here’s why bookkeeping is essential:

- Ensures accurate financial reporting.

- Helps in planning and budgeting.

- Supports tax compliance and preparation.

- Attracts potential investors.

Bookkeeping Basics: What Every Small Business Needs

Understanding the basics of bookkeeping is essential for small business owners. Accurate financial records form the backbone of smart financial management. Clear record-keeping enables simple daily operations and long-term strategic decisions.

Every small business should start with a solid chart of accounts. Categorizing all income and expenses facilitates straightforward financial reporting. Make sure each transaction is recorded promptly to maintain accuracy.

A dedicated business bank account is another must-have. Keeping personal and business finances separate reduces confusion and simplifies bookkeeping. Incorporate these essentials into your routine to streamline your finance management:

- A chart of accounts for categorizing transactions.

- A separate business bank account.

- Accurate, daily transaction records.

- A system for tracking accounts payable and receivable.

Embrace these bookkeeping basics to build a stable financial foundation. Whether your business is small or growing, these fundamentals ensure you stay organized and efficient.

Daily Bookkeeping Checklist

Daily bookkeeping tasks ensure your financial records remain accurate and up-to-date. Consistency is key in maintaining the financial health of your business.

Start by checking and recording all the day’s financial transactions. This includes sales, expenses, and deposits. Make sure every transaction is entered correctly.

Next, address any outstanding invoices. Following up on late payments helps maintain positive cash flow. Prompt updates prevent future surprises.

It’s also a good practice to review your cash position daily. This means verifying your cash flow to ensure you can cover expenses. Keeping a close eye on this helps avoid any financial hiccups.

Incorporate these daily tasks into your routine:

- Record all daily transactions accurately.

- Follow up on outstanding invoices.

- Review the day’s cash position.

Taking these steps daily fosters accuracy in your bookkeeping. It lays the groundwork for smoother weekly and monthly financial reviews.

Weekly Bookkeeping Checklist

Weekly bookkeeping tasks provide a deeper dive into your business finances. Tackling them allows for adjustments and strategic planning.

Start with bank statement reconciliation. Ensuring your bank transactions match records helps identify discrepancies early. It’s a cornerstone practice for accurate bookkeeping.

Review your accounts payable and receivable each week. This entails checking invoices from vendors, confirming payments, and resolving disputes. Maintaining a grasp on these accounts aids in budgeting.

Assess expense tracking for accuracy and completeness. Confirm each expense falls into the correct category. Proper classification ensures reliable financial reports and insights.

As part of your routine, compile a weekly checklist:

- Reconcile bank statements with financial records.

- Review accounts payable and receivable.

- Verify and categorize all expenses.

Regularly completing these tasks avoids backlog, easing monthly and quarterly financial management. This weekly check-up reinforces your financial strategy’s foundation, supporting informed decision-making and growth.

Monthly Bookkeeping Checklist

At month’s end, it’s time to give your bookkeeping records a thorough review. Monthly tasks delve deeper, ensuring everything aligns for quarterly and annual assessments.

Start by analyzing your financial statements, such as income statements and balance sheets. These documents provide insight into your small business’s financial health, allowing for strategic adjustments.

Examine your cash flow statement closely. Understand where money is going and where it’s coming from. This helps pinpoint areas for improvement and potential savings.

Don’t forget to reconcile your credit card statements. This step is crucial for spotting any unauthorized or erroneous charges. Regular checks enhance financial accuracy and security.

Set aside time each month to update and verify your budget. Ensure it reflects any new expenses or income. Maintaining an accurate budget helps in forecasting future cash needs and planning for growth.

Here’s a handy monthly checklist:

- Analyze financial statements.

- Review cash flow statement.

- Reconcile credit card statements.

- Update and verify budget.

Monthly reviews serve as a touchpoint for your financial strategy, supporting consistency and long-term success.

Quarterly Bookkeeping Checklist

Quarterly bookkeeping calls for a deeper dive into your financial data. This provides a comprehensive view of your small business’s trajectory. Reviewing your accounts quarterly helps identify trends and prepare for tax payments and filings.

First, conduct a thorough review of your profit and loss reports. This will spotlight areas needing cost control or investment adjustments. It’s an opportunity to align your spending with business goals.

Secondly, inspect and adjust your payroll records. Ensure compliance with tax obligations and verify accurate employee payments to avoid future discrepancies.

Finally, check inventory levels if applicable. Accurate inventory tracking prevents losses and ensures your product offerings are meeting demand.

Quarterly checklist tasks include:

- Reviewing profit and loss reports.

- Updating payroll records.

- Checking inventory levels.

Annual Bookkeeping Checklist

The annual bookkeeping process involves an in-depth financial analysis. This ensures your small business is ready for the year ahead. Start by closing your books and reconciling all accounts. This step confirms all financial transactions are accurately recorded.

Next, generate and review detailed financial statements. These documents provide insights into your business’s overall performance and aid strategic planning. Identifying trends in revenue and expenses can guide future decisions.

Preparing for tax season is another key annual task. Collect all necessary documentation to facilitate accurate and efficient tax filing. Staying organized helps in avoiding any surprises during tax preparation.

Finally, reflect on your bookkeeping processes over the year. Consider any improvements or adjustments for better financial management. This reflection can lead to enhanced efficiencies and savings.

Annual checklist tasks include:

- Closing and reconciling accounts.

- Reviewing financial statements.

- Preparing for tax filing.

- Reflecting on bookkeeping processes.

Bookkeeping for Tax Preparation: What to Organize

Organizing your financial records for tax preparation can save you valuable time and reduce stress. Start by gathering all necessary financial documents related to income and expenses. This includes receipts, invoices, and bank statements.

Next, ensure your expense categories align with your tax reporting needs. Consistent categorization aids in simplifying the tax filing process. Mismanaged categories can lead to errors and increased scrutiny during tax audits.

Finally, keep updated records of all deductible expenses. Knowing what qualifies as a deduction helps in maximizing your tax savings. Invest time upfront for a streamlined tax season.

Key documents to organize include:

- Income and expense records

- Receipts and invoices

- Bank and credit card statements

Bookkeeping Tools and Software Recommendations

Choosing the right bookkeeping tools can elevate your financial management. Many software options offer automated features that save time and reduce errors. These tools are indispensable for small business finance, providing real-time insights.

Consider programs that offer cloud-based access for convenience and collaboration. Ensure that the software supports essential functions like invoicing and expense tracking. Ease of use and customer support are also crucial.

Here are some popular bookkeeping tools:

- QuickBooks

- Xero

- FreshBooks

- Wave Accounting

Using the right software makes maintaining your bookkeeping checklist simpler and more efficient.

When to Hire a Professional Bookkeeper or Accountant

As your small business grows, bookkeeping demands can increase. You might find you lack the time or expertise to manage your books effectively.

Consider hiring a professional if:

- Your bookkeeping tasks are overwhelming.

- You need specialized financial advice.

- You face complex tax situations.

Engaging a professional ensures accuracy and compliance, freeing you to focus on your core business activities.

Bookkeeping Tips for Growing Businesses

As your business grows, bookkeeping becomes more complex. Proper financial management is crucial for sustainable growth. Here are some tips to streamline your bookkeeping processes:

- Regularly review and update your financial records.

- Implement a strong internal control system to prevent fraud.

- Use financial data to guide business decisions.

As you expand, consider upgrading your accounting software to handle increased transactions. Advanced tools offer detailed insights and automate many manual tasks.

Engage with financial advisors periodically. They can provide valuable insights and ensure your bookkeeping aligns with your growth trajectory.

Conclusion: Stay Organized and Empower Your Small Business

Effective bookkeeping is key to running a successful small business. By adhering to a structured Bookkeeping Checklist, you can stay organized and compliant.

The effort you invest in managing your finances today will empower your business tomorrow. Stay disciplined with your financial practices and watch your business thrive.