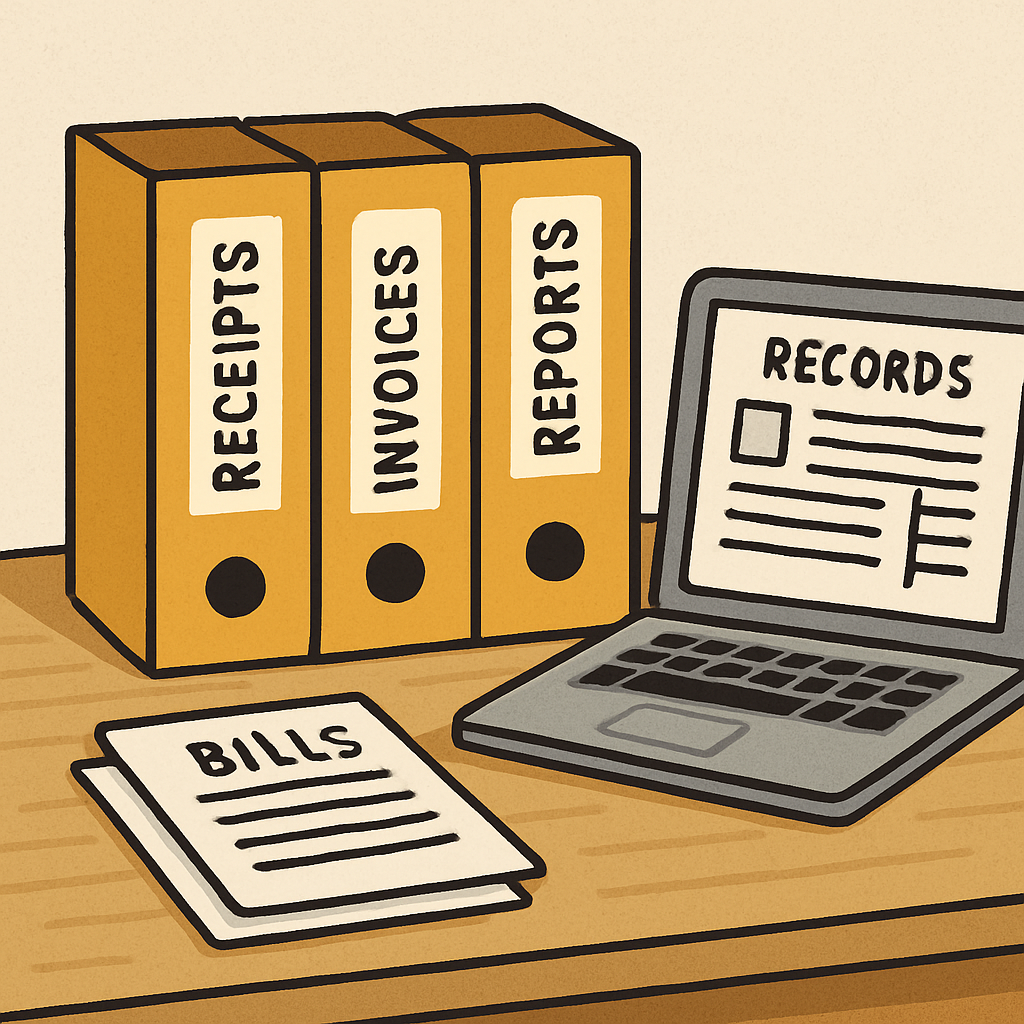

The ATO requires that all businesses file a federal income tax return. This form includes information about your business’s profits, losses, deductions, and credits. It also provides instructions for how to calculate your personal income tax liability.

Individual vs. Business Taxes

As an individual, you pay personal income tax on your earnings. However, you also have super and Medicare taxes on your earnings. These taxes are withheld from your paycheck. As a business owner, you pay corporate income tax on your earnings, plus payroll taxes (Super and Medicare). This means that you will owe both personal and corporate income taxes on your earnings.

Other Important Information

If you own a small business, you must file a separate form with your federal income tax return. You use this schedule to report any income earned by your business.

Paying Self-Employment Taxes

IIf you’re self-employed, you need to pay your own income tax. Tax rates vary based on your taxable income.

Reporting Income

You must report your income on your federal tax return. This includes wages, interest, dividends, capital gains, alimony, child support, and other sources of income.

In conclusion, it’s important to know how to file your taxes correctly so you don’t incur penalties or interest charges.

If you are employed by another company, you must file tax through ATO. This form reports your net profits or losses from your business activities. It includes the total gross income earned by your business, along with any deductions taken against that income.